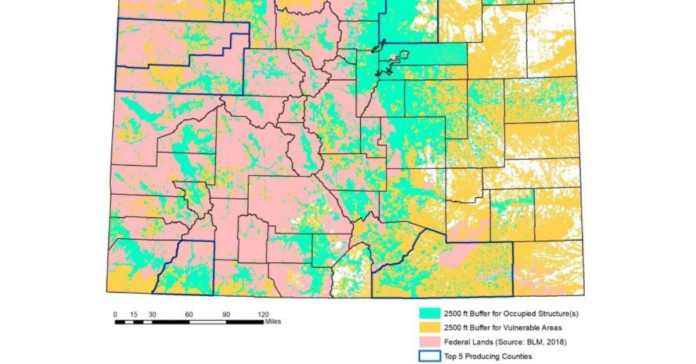

More than half of the state of Colorado would be off-limits to new oil and gas development, including 85.4 percent—or 36.3 million acres of the state’s non-federal lands, according to a new assessment by the Colorado Oil & Gas Conservation Commission (COGCC).

The new calculations by the state’s regulatory body examine the effects a 2,500-foot setback—part of this fall’s ballot Initiative #97—would have if voters approve the measure in November.

COGCC

“An estimated 54% of Colorado’s total land surface would be unavailable for new oil and gas development by adopting the buffer zone setbacks and federal land exemption proposed by initiative #97,” COGCC wrote. “Of the non-federal land in Colorado, 85% would be inaccessible using these same criteria.”

In Colorado’s most active oil and gas producing county, more than 78 percent of Weld County’s surface area, including 85 percent of non-federal land, would be subject to the extended setback, COGCC found.

Weld County leads the state in both oil and natural gas production, accounting for more than 90 percent of the state’s oil production and 39 percent of its natural gas production through the beginning of 2018, according to county statistics.

“In Colorado’s top five oil and gas producing counties combined, 61% of the surface acreage (94% of non-federal land) would be unavailable,” COGCC wrote. That includes Weld, Garfield, La Plata, Rio Blanco, and Las Animas counties. In three of those counties, Garfield (99.8 percent), La Plata (99.9 percent), and Rio Blanco (99.8 percent), nearly all non-federal surface area would be removed from potential development, with Las Animas just behind, losing 96.6 percent of its non-federal surface area to the new buffer zone.

The COGCC’s GIS [Graphic Information System]-Based Impact Assessment was requested by the board’s commissioners.

Proponents of Initiative #97 are currently gathering signatures due by August 6, 2018. Colorado Rising will need more than 98,000 valid signatures to be successful and place the initiative on the November 6 ballot.

A similar 2500-foot buffer was proposed in 2016, but was intended to modify the state constitution and not Colorado Revised Statutes, as the 2018 version does. Also, the 2018 ballot initiative exempts “federal land” from the setback away from any “occupied structure” or “vulnerable areas” included in the ballot language.

The report cautions that while that would allow some areas of Western Colorado to retain land for new oil and gas development, it has “little impact” in the state’s eastern half, including Colorado’s most prolific county.

“The proposed federal land exemption, which in Colorado would be an estimated 36% of the state’s total surface area, does keep land available for oil and gas development in western Colorado, but has little impact on lands east of the Rockies including in Weld County,” COGCC wrote. Those federal exemptions include more than 24 million surface acres located primarily in the state’s western half.

COGCC

“‘Occupied structure’ means any building or structure that requires a certificate of occupancy or building or structure intended for human occupancy, including homes, schools, and hospitals,” Initiative #97 states.

“‘Vulnerable areas’ means playgrounds, permanent sports fields, amphitheaters, public parks, public open space, public and community water sources, irrigation canals, reservoirs, lakes, rivers, perennial or intermittent streams, and creeks, and any additional vulnerable areas designated by the state or a local government,” it continues.

Combining the two categories leads to the near de facto prevention of any new oil and gas development on non-federal surface area, critics say.

Colorado Petroleum Council’s Executive Director, Tracee Bently, called Initiative #97 “bad for Colorado all the way around.”

“Clearly this is an attempt to stop energy development in our state and this impact statement proves it,” Bentley said in a statement earlier this week.

In the state’s five most productive counties, nearly 94 percent of non-federal land would fall under the new 2,500-foot exclusion zone. Adding the hydrologic “vulnerable areas” to the setback buffer “would have a significantly larger impact than ‘occupied structure’ buffers on making surface lands inaccessible to new oil and gas activity,” the COGCC added.

A June study commissioned by the Colorado Alliance of Mineral and Royalty Owners (CAMRO) found that policies or ballot measures aimed at the state’s oil and gas development could cost the state up to $180 billion and up to $26 billion for mineral rights owners.

“The biggest takeaway is the staggering dollar amount,” CAMRO President Neil Ray told Western Wire last month. It would also prompt lengthy legal battles between the state and mineral owners, Ray said.

“I think that you would see lawyers lining up for miles,” said Ray. “Court cases show that if there is a regulatory taking where some regulation or law is passed that causes some property to be diminished in value or completely lose its value, there is deserved just compensation.”

The COGCC report does not include any mineral development analysis or economic impacts assessment as a result of the reduction in surface area availability for new oil and gas projects.